Corporation Tax

Rates

The rates for today and for the past few years are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 | 2024 | 2025 |

| Corporate Tax main rate | 19% | 19% | 25% | 25% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% | 19% | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 | £50,000 | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 | £250,000 | £250,000 |

| Standard fraction | N/A | N/A | 3/200 | 3/200 | 3/200 |

| Main rate (all profits except ring fence profits) | 19% | 19% | N/A | N/A | N/A |

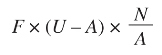

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400. This has applied for all financial years from 2008.

Research and Development (R&D)

R&D Tax Relief – Rules for 2025/26

From 1 April 2024, a new merged R&D scheme replaced the previous SME and RDEC schemes for most companies. However, a modified SME scheme — called Enhanced R&D Intensive Support (ERIS) — remains available for R&D-intensive, loss-making SMEs as of April 2025.

The Merged Scheme

- Applies to most companies for accounting periods starting on or after 1 April 2024.

- Offers a 20% taxable expenditure credit on qualifying R&D costs.

- Available to companies within the charge to UK Corporation Tax with R&D projects aimed at advancing science or technology.

- The qualifying expenditure rules remain similar to the old schemes, covering staffing, software, consumables, utilities (excluding rent), and subcontracted R&D under certain conditions.

Enhanced R&D Intensive Support (ERIS)

- Available to loss-making SMEs that spend at least 40% of total costs on qualifying R&D.

- Allows a total deduction of 186% (100% base + 86% enhancement).

- Offers a non-taxable payable credit worth up to 14.5% of the surrenderable loss.

Companies cannot claim both ERIS and the merged scheme for the same expenditure but can choose between them if eligible.

Schemes for Periods Starting Before 1 April 2024

SME Scheme

Provided a 230% deduction before April 2023; reduced to 186% from April 2023.

Loss-making SMEs could surrender losses for:

- 10% credit generally

- 14.5% if R&D-intensive (?40% spend on R&D)

RDEC Scheme

For large companies or SMEs not eligible for the SME scheme.

Offered a 20% taxable credit on qualifying R&D spend.

R & D Summary

In conclusion, from 1 April 2024, the previous SME and RDEC schemes have been consolidated into a single R&D Tax Relief scheme for most companies, with the exception of the new Enhanced R&D Intensive Support (ERIS) scheme, which remains available for R&D-intensive, loss-making SMEs.

The key difference is that the merged R&D Tax Relief scheme now applies to most companies, whereas the Enhanced R&D Intensive Support (ERIS) scheme is specifically for R&D-intensive, loss-making SMEs, which was not the focus of the previous schemes.

For more information see our ...

Book a Free, No Obligation Consultation

Take advantage of a free consultation to see how you can benefit from using Stanhope accountancy and advisory and find out the best way to deal with your tax, accounting and how to minimise your tax liabilities. Book now >

Get a Fixed Quote

We believe you should always be in control of your finances. For this reason we can offer many of our services on a fixed fee basis on agreed services >

Profitability Strategies

We can help you develop strategies to help your business grow without increasing costs specialized tax incentives to produce multiple benefits and help you increase your profit >

Your Business

Expert tax planning advice any size business tailored to you >

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.

Cookies are small text files that are stored on your computer when you visit a website. They are mainly used as a way of improving the website functionalities or to provide more advanced statistical data.